TAX LAW TRAINING CENTER

Advanced Nonprofit & Tax Law Strategies

For Lawyers, Accountants, Financial Advisors - And Their Clients

Learn Tax Strategy:

Understand how Tax Law impacts every dollar we earn, save, invest, or gift.

Apply Tax Strategy:

Apply these strategies in your business and life to maximize your wealth & minimize taxes.

Offer Tax Strategy:

Enter the world of high-end tax strategy where you can charge what you're really worth.

Who Is This For?

This program is specifically designed for:

Law firm owners from diverse practice areas who are looking to understand how tax law impacts their clients, and how to incorporate nonprofit and tax concepts to boost earnings per case, create more robust legal solutions, fix tax obligations created from their legal work, and help their clients protect their wealth from all sides.

Accounting firm owners and bookkeepers who are looking to enter the world of proactive and strategic tax consulting, enhance the value they offer, and build a book of business with million-dollar companies, wealthy families, and high-income-earners.

Licensed Financial Advisors looking to stand-out from unlicensed competitors, create authority and preeminence in their market, and enhance client loyalty by offering unmatched value to your clients - while boosting AUM and creating additional income streams.

Please note: This program is ONLY available to licensed professionals who already operate a law firm, accounting firm, or financial advisory firm (some startups will be considered). We will verify your license before accepting you into the program.

10th

Experience

Become The Most Trusted

Advisor Your Clients Can Turn To.

The vast majority of your competitors do not offer strategic and tactical legal and tax restructuring services, especially those that involve shifting the manner in which clients earn, save, invest, and transfer wealth during their lives and post-death. Start serving client who have sophisticated portfolios and large tax bills who need LICENSED professionals to help them - or continue to sit back and watch scammers & imposters fill that space.

Successful Entrepreneurs

Start attracting and representing entrepreneurs with thriving businesses that need more than bookkeeping and filing services - they need proactive strategy.

Seasoned Investors

Work with seasoned investors with sophisticated portfolios that need legal and tax reorganization to mitigate 6, 7, or even 8-figures in taxes.

High-Income-Earners

Serve high-income-earners and high-net-worth families who need more than a simple estate plans - they need advanced nonprofit & tax integrations.

I Didn't Choose Tax Law,

It Choose Me.

Dear Attorney, Accountant, and Financial Advisor:

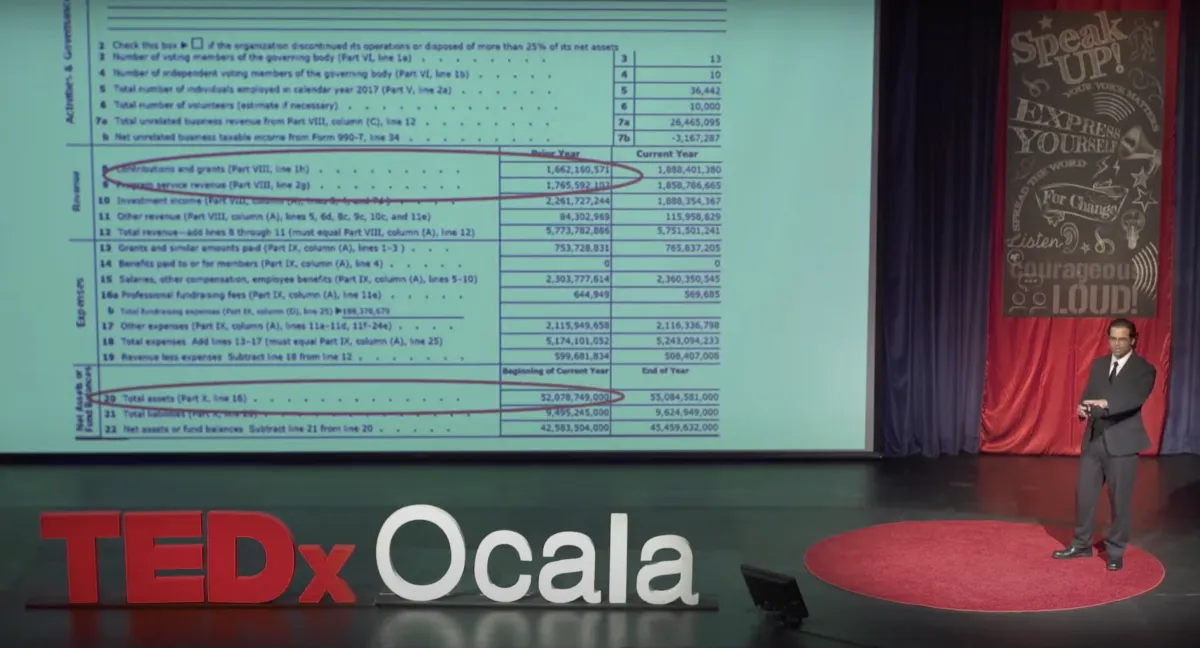

It's TEDx Speaker, Forbes & Entrepreneur Contributor, Tax Researcher, Impact Investor, and International Business & Tax Lawyer, Sid Peddinti™ here - it's a pleasure to meet you.

I'm thrilled that you are interested in learning and offering tax law services to your clients - it's lucrative, flexible, highly stimulating, relatable to your own situation, and it's something that's in extremely high-demand with very low-supply, especially from licensed professionals.

I created The Tax Law Training Center™ with three specific goals in mind:

EMPOWER CONSUMERS:

Help consumers protect their assets, their wealth, their peace of mind, and save a ton on taxes - legally and ethically.

EMPOWER LAW, TAX, AND FINANCE PROFESSIONALS:

Help lawyers, accountants, and financial advisors learn tax law, apply it in their own life, and offer it to their clients, and in that process bridge the "tax gap" that dilutes the work these professionals are doing.

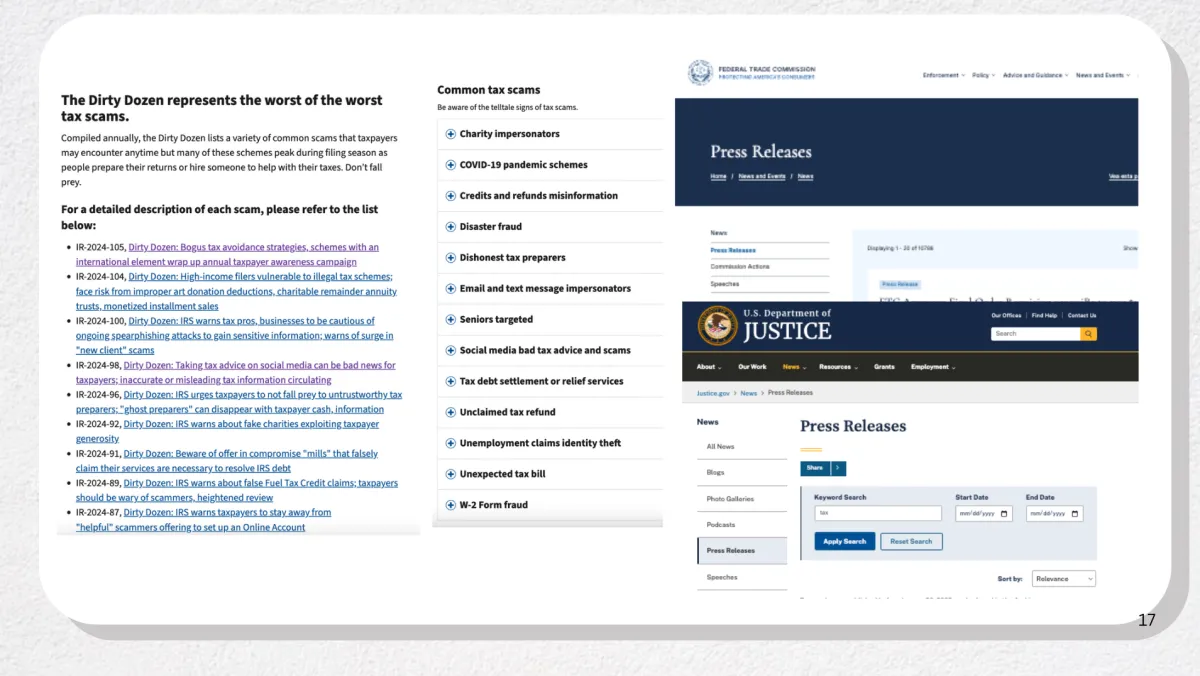

BATTLE SCAMMERS & IMPOSTERS:

Bridge the gaps in communication and strategy ("the tax gap") between these three professions, which is being filled & occupied by unlicensed professionals - who are now offering Legal, Tax, and Financial Consulting, Entity Structuring, and even full-blown Estate plans,Complex trust structures, and all sorts of investment schemes and scams that are destroying thousands of honest and innocent families.

Now that AI has become more mainstream, you're going to see scammers, fraudsters, and imposters spread like wildfire in most legal, tax, and financial niches - and that's why this work has become more important and critical than ever before.

LICENSED professionals need to step-up, learn legal & tax structuring, offering it to their clients, and in the process, slowly eliminate and push-out the scammers and imposters - who have are actively snatching and stealing our clients and the services we were trained and are licensed to offer.

Over the years, we have met HUNDREDS of people from all walks of life who have been impacted this "TAX GAP", including brilliant attorneys, accountants, doctors, chiropractors, podiatrists, inventors, scientists, business owners, investors, realtors, C-Suite executives, and even JUDGES.

It can happen to anyone, especially if you don't understand how tax concepts work, which are not taught in school, university, or even law school. Tax law was a third year elective and 90% of the lawyers that I've have met to date have no tax knowledge, training, or experience. That's where we fit and that's the exact gap that we're on a mission to bridge.

Our big, bold mission at The Tax Law Training Center™ is to help people learn tax law and make smart, educated, and wise decisions across all fronts.

We invite you explore the various resources that we've put together for you to explore - and when you're ready to dive deeper - fill the form, watch the training video, and schedule a call with me to discuss how we can transform your firm into a boutique high-end nonprofit & tax consultancy.

Why Learn Tax Law?

YOU DON'T KNOW WHAT YOU DON'T KNOW.

Tax law is a body of law that is so complex and so vast, that there is a lot that you don't know, and it's virtually impossible to know it all. Yet, when legal, tax, and financial strategies are misaligned and mismatched, clients pay the price - sometimes losing decades of accumulated wealth in an instant.

WHY DO I NEED TO LEARN TAX LAW WHEN I HAVE THE BEST EXPERTS GUIDING ME?

That's a question that I've heard from entrepreneurs and investors thousands of times - and it's how I used to think as well. But that changed in 2005 when my lawyers, accountants, and financial advisors could NOT stop the banks from piercing my corporate and estate structures, seizing and auctioning all my assets, and forcing me into a multi-million dollar bankruptcy at the age of 22.

I've worked with thousands of people over the years who have made these mistakes and ended up in similar situations, except they were in their 50s, 60s, 70s, and even 80s, not in their early 20s. They have a lot more at stake - these are individuals who have worked their entire life to build something and it's destroyed due to poor legal and tax planning, or a lack thereof.

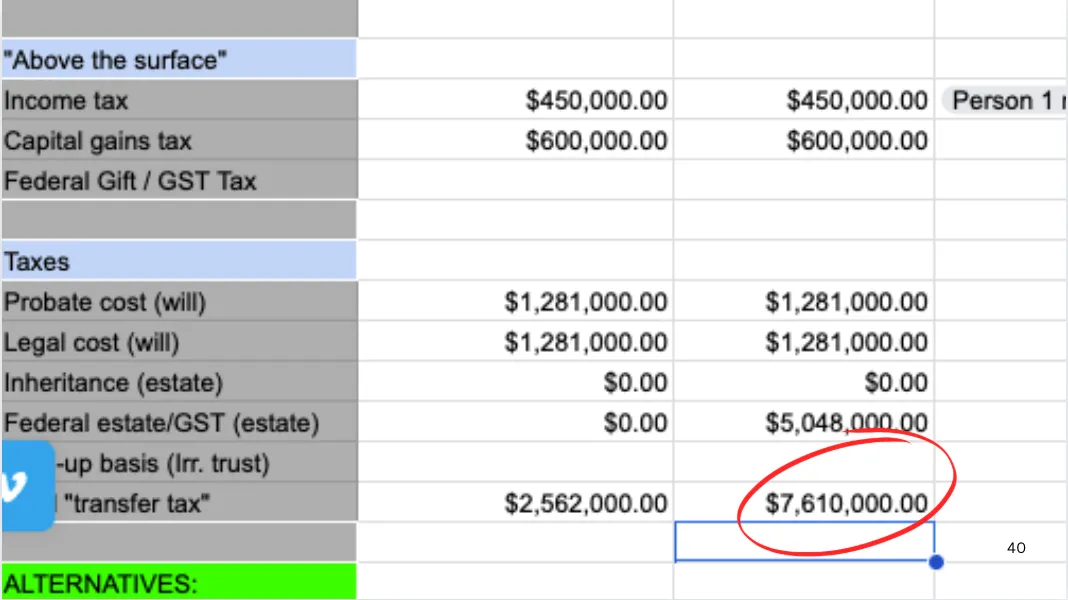

Often, these folks are not here to even witness the lawsuits and big tax bills that are levied on their estate - in other words, their surviving spouse and heirs have to deal with this complex and stressful process during the worst time - right after the death of a loved one.

That's what learning and offering proactive legal and tax strategy can do:

Prevent those nasty situations from happening - and if not you (a licensed and trained professional) are willing to learn and offer tax strategy, then who - scammers and imposters?

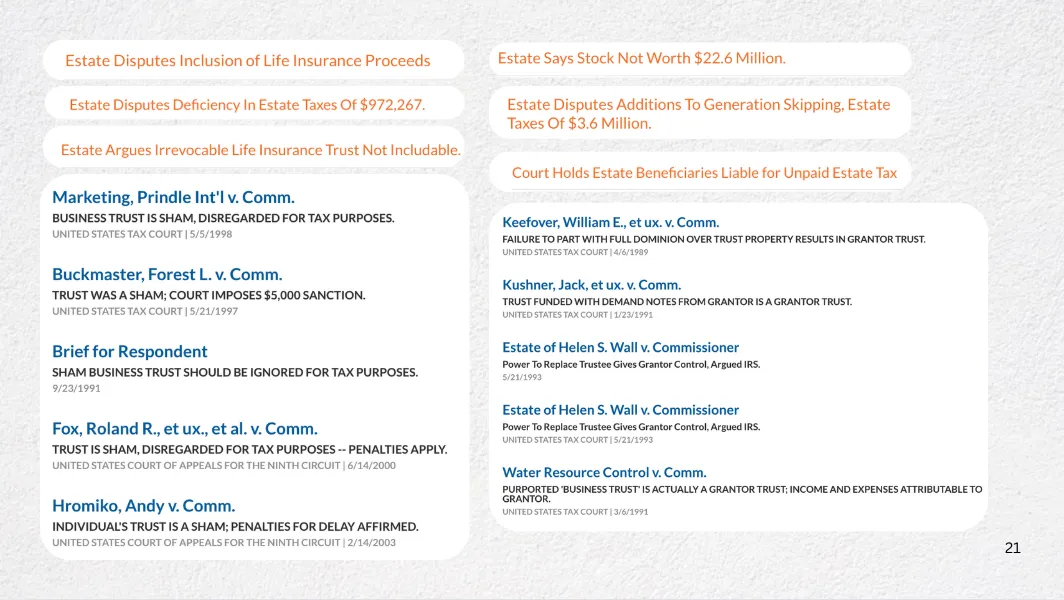

Take a look at a few cases below where trusts were pierced, beneficiaries were responsible for estate taxes, business valuations that resulted in 8-figures in tax bills, and destruction of people's dreams and accomplishments due to a lack of proactive planning.

Nonprofit and Tax Restructuring can prevent these situations from happening...

Tax Strategy Is Not Bookkeeping, Filing Tax Forms, Or Tax Preparation

IT'S MORE LIKE CHESS,

STRATEGIC AND TACTICAL.

Tax Consulting is not just important - it's noble, honorable, and even charitable in way:

In fact - the incorporation of charitable entities (tax-exempt corporations) is one of the top strategies that I discovered during my legal training and research (especially during my LLM) - The Power of "nonprofits and foundations" as a business, estate, and tax strategy™.

I call this BENT Law™: The strategic integration of Business, Estate, Nonprofit, and Tax Law™:

All of which are highly interconnected, intertwined, and go hand-in-hand. The tax code loves philanthropists™ and there's a reason why billionaires and wealthy families use foundations extensively.

A big component of ADVANCED business, estate, and tax planning is learning how to leverage the power of nonprofits and foundations in combination with other business, estate, trusts, and for-profit entities.

In my experience, tax-exempt entities are underutilized and completely overlooked by most entrepreneurs, investors, and their advisors, yet that's where the secrets to multi-generational tax-favorable wealth management can be found.

The incorporation of nonprofits and foundations is "Good For Business, and Good For Society":

It's a strategic move that is beneficial for the business, for the brand, for tax reasons, for estate planning purposes, for business expansion, for innovative financing, for innovation and first-mover advantages in R&D, and beneficial for your entire family tree at the same time.

That's why Gates, Buffet, and others lead through philanthropic work and have openly talk about earmarking 99% of their wealth for charitable work - strategic philanthropy is one of the MOST powerful business, estate, and tax strategies out there. These entities offer a true alternative way to earn, manage, and pass-on wealth in a manner that can bypass the tax-scammers and legal-imposters that are offering baseless, made-up strategies.

There are entire communities of folks who even preach how taxes are unconstitutional and illegal, and there are a lot of good folks that have fallen for these traps - intentionally or unintentionally. The schemes are elaborated and highly planned - but lawyers and accountants can mitigate the damage caused by these unlicensed imposters.

Nonprofits and foundations operate in perpetuity and are not a part of the donor's estate:

Those assets legally and ethically bypass probate, inheritance tax, estate and gift tax, generation-skipping-tax, trust & estate taxation, and even the step-up rules that changed recently. One move can eliminate some of the crazy tax bills and lawsuits that are in the picture above!

So, that's what advanced nonprofit and tax restructuring and consulting is in a nutshell:

Rising above billable hours, one-off transactions, and low-priced legal and tax work and stepping into advanced entity restructuring.

Offering proactive tax strategy where you're helping your clients leverage ALL their options - you become a Law & Tax Architect™.

Crystalizing your role as the Law and Tax Watchdog™ - the most trusted expert that clients and their advisors can turn to for guidance, strategy, and mentorship - while saving everything, protecting everything, and retaining more in the process.

Elevate Your Brand, Your Reputation,

And The Value You Bring To The Table.

Learn how to uncover hidden tax traps, protect millions in client wealth, and take back the marketplace from unlicensed imposters offering reckless legal, tax, and financial advice. It’s time to reclaim your value, protect your clients, and defend the integrity of our profession - before it’s priced out, sold short, and diluted by those who’ve never passed the bar or even a secured a license to offer these strategies in the first place.

Solve "Million-Dollar" Problems

Position your firm to serve successful business owners, investors, and legacy-driven families seeking elite legal-tax strategy, not just filings and simple estate plans.

Offer Infinite ROI To Clients

Deliver tax reduction plans that work - through trusts, foundations, partnerships, cost segregation, and advanced planning tools that last many generations.

Bypass Imposters & Scammers

Stand-out from unqualified and unlicensed scammers and imposters - and protect your clients from falling for their traps and losing it all.

Program Details

Curriculum Overview

100% Practical, Hands-on, and Application-Based Training

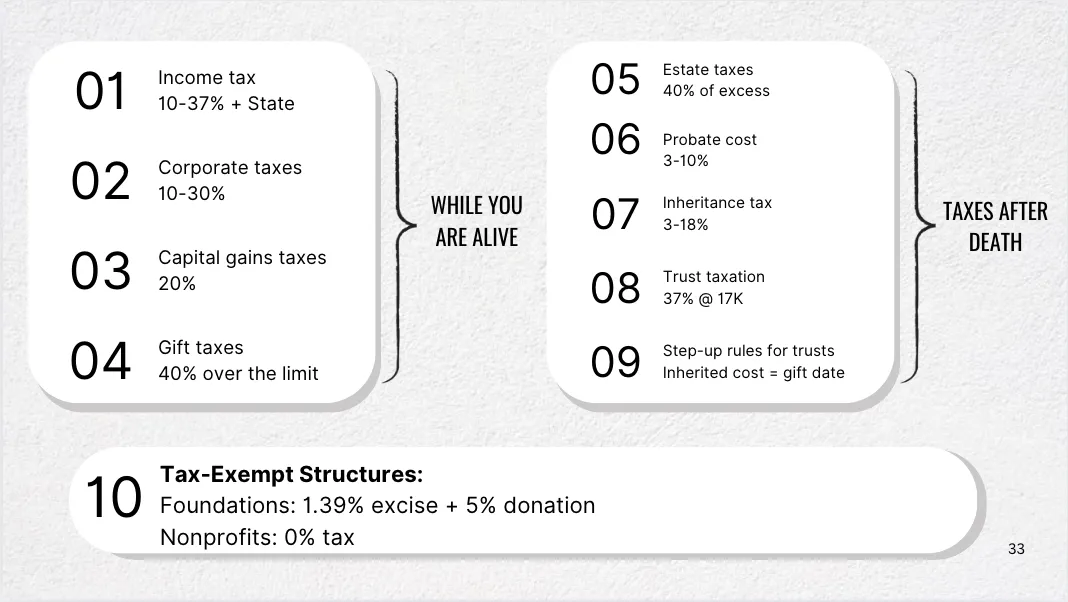

Tax Fundamentals: Understand the layers of U.S. taxation:

Income tax

Corporate tax

Capital gains tax

Gift, estate, and GST tax

Trust/estate tax

Step-up rules tax

Tax-exempt entities:

501c3 public nonprofit

501c3 private foundation

Big Picture Strategy: Law & Tax Restructuring:

Learn to evaluate a client’s entire business, estate, and tax profile

Identify opportunities, inefficiencies, and overlooked liabilities that you can spot and solve for them.

Cases & Codes: Real cases, real results, real impact:

Explore real cases, IRS publications, and tax codes to understand how you can navigate law and tax topics strategically

Understand how various entities and strategies can be pierced or challenged - real cases from the Supreme Court, IRS, and Tax Courts

Worst-Case Scenarios: Spot them and prevent them:

Unpack what happens when no planning is done:

Bankruptcy while alive

Taxable estate at death

Family conflict and wealth erosion

Court intervention and dilution

Getting technical: Leveraging the law to earn, grow, and transfer in a tax-optimized manner:

Earning Smarter:

Structure income and business revenue to lower exposure and improve margins.

Growing Efficiently

Use trusts, foundations, and asset protection tools to preserve and multiply wealth.

Transferring Intelligently

Design gifting, inheritance, and charitable strategies that legally bypass tax traps.

Practical Use Cases: Situations you are likely to encounter and how to solve them:

Life insurance as a tax-free wealth transfer tool and also death tax trap

Business succession and ownership restructuring with trusts & foundations

Strategic asset repositioning using LLCs, partnerships, trusts, and foundations

Grantor vs. Non-grantor trust design and tax treatment - rules and regulations

Spotting and avoiding scammers, fraudsters, and imposters who are doing legal and tax work

DIFFERENT MODELS

FOR DIFFERENT GROWTH MODES.

We understand that everyone's interest level, comfort level, and experience is different, and we've created different models of integration to cater to your interest level - whether it's tapping into this area in a passive manner, active manner, or aggressive, enough-is-enough, time to take back control of the marketplace manner. As you might have guessed - Sid & his partners are in this mode and ready to regain the reins and push our imposters.

Tax Law Affiliate Program™

This model is for lawyers, accountants, and advisors that want to solve these problems, but rather refer the clients to us, and collect a referral fee - hands-off model where we'll qualify and deliver the solutions.

Included with this program:

Customized and branded landing page(s)

AI-powered content creation prompts

Case studies and tax law resources

Customized Intake forms

Customized tax calculators

Tax Firm Incubator Program™

This model is for professionals who are ready to start taking on tax work in a limited capacity, mainly doing front-end assessments, and handling sales calls - we'll train you and work as strategic partners.

Included - All the affiliate features and:

Training on advanced issue spotting & sales calls

Creation of referral partnerships with other firms

Boosting earnings on existing work with tax work

An in-kind grant of $50,000 that covers AI-Powered experiments to promote your firm

Tax Firm Accelerator Program™

This model is for professionals that don't need to be convinced - they already know what's at stake and are ready to rise to the top of the "tax advisory" chain by learning, applying, and offering tax strategy.

Included - All the Incubator features and:

Training on advanced tax strategies and topics

Training on public speaking and content creation

An in-kind grant of $100,000 invested in your firm

Co-creation of multiple legal offers and educational funnels, funded by corporate grants

YOU ARE NOT ALONE,

WE'RE ON THIS MISSION TOGETHER.

What You’ll Learn in the Mini Family Office™ Training:

Not Taught in Law School or LLMs: 100% application-based training from 20+ years of real legal and tax restructuring cases and learning HOW to put it all together as a business offering.

Thousands of Hours, Compressed: Learn how family offices integrate legal, tax, and financial strategies for the ultra-wealthy - and how you can do it too.

Mini Family Office™ for Solo Lawyers: Deliver high-end, multi-advisor experiences without needing to hire a full team.

What We’ll Help You Build:

Your Own Boutique Legal & Tax Consulting Firm (or bolt-on offer), serving clients across all 50 states.

Premium Positioning: Strategic content + messaging to attract clients who understand real value.

AI-Enhanced Research & Marketing: Train AI to verify codes, generate IRS-backed content, and build tools like tax calculators.

Estate & Asset Gap Analysis: Spot red flags, scams, sham structures, and formulate powerful, ethical alternatives.

Deal Flow & Delivery: Master client interviews, proposals, pricing models, JV implementation, and compliance.

Nonprofit + Foundation Integration™: Use advanced structures to increase client lifetime value and tax efficiency.

Full Tech Stack: Websites, automations, campaigns, risk tools, billing systems, and client-facing apps.

Live Mentorship: Bring your client cases - we solve them together, in real time (like researchers on a mission)

Pricing & Compliance: Learn to ethically charge for sophisticated tax strategies and restructure value-based offers.

Bigger Mission:

We’re not just reducing taxes - we’re helping you turn clients into philanthropists, impact investors, and legacy-builders using the full force of the tax code.

Join the movement. Leverage the tax code. Empower your clients. Build a lasting legacy.

~ Sid Peddinti™

(Yes, the ™ on your name is a strategy too that has legal, tax, and financial advantages - we can explore that too)

We've Been Working Hard,

But The Imposters Are Working Harder!

THAT'S WHY WE CREATED THIS CENTER - TO TEACH YOU, EMPOWER YOU, AND PARTNER WITH YOU.

Here are some stats from my efforts so far...

Over $5 billion in assets and intellectual property restructured and protected for clients since my own bankruptcy in 2005

Over 10,000 cases under our belt in various business, estate, nonprofit, and tax integrations and solutions

Started 3 legal AI-powered software companies, the first one in 2015, then in 2017, and more recently in 2022 (with ChatGPT, etc.)

Filed, created, and represented over 25,000 "persons" (defined in the tax code as an individual, corporation, trust, estate, or association) - tax law is a technical game with precise definitions.

Over $50 million in corporate grants and funding secured for clients to advance education in 100+ unique industries

Presented nonprofit and tax topics across 250+ stages, podcasts, and masterminds since 2015

Unlocked millions in corporate funding and grants to teach the law and empower people with legal and tax knowledge & resources

Over 1 million people empowered through our training efforts

Over 500 referral partners trained since 2008 to spot issues and refer business in the three models that we still offer - it works.

Let me be clear - I am not presenting this information to boast, but to portray the fact that despite my efforts and accomplishments, the scammers and imposters have worked even harder and have managed to grab a big share of the current "high-end tax strategy" marketplace.

I'm generally the ONLY licensed professional at conferences and masterminds who can discuss legal and tax strategy - meanwhile, there are generally 5-10 business, estate, and nonprofit experts, with no licenses, no qualifications, and no training whatsoever who are discussing "control everything, own nothing" and grabbing the lion's share of the business in these rooms and conferences.

We need you to join the movement and recapture the deals that we (licensed professionals) should be working on. Let's do this!

I've shared and presented philanthropic tax strategies across various stages and platforms, here are a few of them:

THE NEXT STEPS

100% RISK-FREE AND PRESSURE-FREE STRATEGY CALL TO EXPLORE A JOINT VENTURE WITH US

1. Fill out the application form and provide details on your current business, offerings, and book of business

2. Schedule a call to discuss how you can leverage this model to enhance your firm and offerings

We will review your application, cross-check your license, and email you a link to view a detailed webinar that covers all the nuances and questions you have on the integration of tax strategy and consulting services into your offerings.

We want to ensure our intellectual property, ideas, strategies, and discoveries are protected from scammers, copycats, and imposters, and in an effort to preserve the integrity of this powerful information, we do not release our training material to the public.

FOLLOW US

LEGAL

Copyright © 2025. Tax Law Training Center™, The Tax Iceberg, BENT Law, Mini Family Office, Tax Law Incubator, and Tax Firm Accelerator are trademarks owned and operated by Sid Peddinti™ and Become A Philanthropist™ LLC. All Rights Reserved.

No Legal, Tax, Financial, Or Investment Advice Provided Or Contained In Presentations Or Training Sessions - All Material Presented Are Strictly For Education and Entertainment Purposes Only. The Results, Examples, and Scenarios Described Are For Marketing And Demonstration Purposes Only And Do Not Guarantee Any Results, Income, Or Profits In Any Capacity - Every Situation And Case Is Different - We Do Not Make Any Explicit Or Implied Guarantees In Any Way Whatsoever.

By Filling Any Forms, Engaging With Us, Or Booking Appointments, You Expressly Agree And Consent To These Disclaimers And Terms.